In this article we would like to present and compare two jurisdictions commonly chosen by digital nomads as the place of incorporation of their limited companies.

Why limited companies? Because these are entities independent of their owners or directors, which means they are safer (due to the limited liability of their shareholders) and do not require you to personally be a tax resident in the place of their incorporation. This is crucial for digital nomads.

For the purposes of this article, let’s assume you personally are not a tax resident of either Estonia or the UK, you’re traveling the world with no clear, stable place of residence.

(If you would like to learn more about the different aspects of tax residency, visit How to Become a Digital Nomad – Guide to Taxes and Business Registration and look into the Digital nomad taxes section.)

Branding-wise, Estonia is clearly a leader in this match-up as with its e-Residency program and the recent “digital nomad visa” announcements it aims to position itself as THE country in which you should incorporate your business when embracing the nomadic lifestyle.

The United Kingdom, clearly a stable and well-established jurisdiction is a great, however not so well popularized, choice for aspiring nomads. Let us dive into what makes both of these countries attractive for digital nomads (on paper at least) and which one might end up better – for you!

Business registration in Estonia

Business registration in the UK

Taxes in Estonia

Taxes in the UK

Business registration in Estonia

What does it cost to register a business in Estonia?

The most common pathway for registering a limited company (OÜ) in Estonia is via the e-Residency program. First, you will need to apply for the e-Residency card which costs 100 or 120 EUR (100 EUR if you choose to pick the card up in an Estonian location or 120 EUR if you choose to pick it up at a foreign location, that is any Estonian embassy or consulate). Your card will usually arrive at the chosen location in 2-4 weeks.

Once you have your e-Residency card, you can go through the online company registration process, and if you use the available template for the company’s articles of association, the total cost of registering the company will amount to 190 EUR.

In total it costs 290 or 310 EUR to register a limited company in Estonia the simplest way.

However, it’s important to note that an Estonian company is obligated to have a registered address and a representative (contact person) present in Estonia at all times. This means that a simple virtual office will not suffice, and you have to make sure that your registered address or virtual office provider offers the service of a “contact person” as well.

If you were to engage a professional to help with setting up your company in Estonia, the usual fees come around 200-500 EUR for e-Residents (not including the government fees) and start at around 800 EUR if you were to engage a notary and prepare tailored Articles of Association. Bear in mind that registering a company with a notary would require you to visit Estonia or at least grant the Power of Attorney to your representative.

Business registration in the United Kingdom

What does it cost to register a business in the United Kingdom?

The state fee for opening a limited company in the UK is 12 GBP. The whole process can be performed online via the company registration portal.

Registering a limited company in the UK with the help of a professional will usually cost between 50 and 200 GBP. Make sure to check the offer in detail as services at the lower end of the spectrum often come incomplete.

In addition to registering the company with Companies House, one must make sure to:

- Register the People with Significant Control

- Obtain and secure the Certificate of Incorporation, Memorandum of Association and Model Articles of Association for the company

- Obtain the company’s UTR number

- Register for Corporation Tax with HMRC

If you would like to hire employees or even pay out director’s fees to your board, the company will need to be registered for the PAYE scheme. It’s easier to register the company for PAYE if there is at least one company director who has the UK National Insurance Number (NIN), but it’s not impossible if there isn’t one. Our pricing for company registration in the UK is 120 GBP for directors with NIN (state fee included) and 192 GBP if the company does not have a director with NIN.

Taxes for digital nomads in Estonia

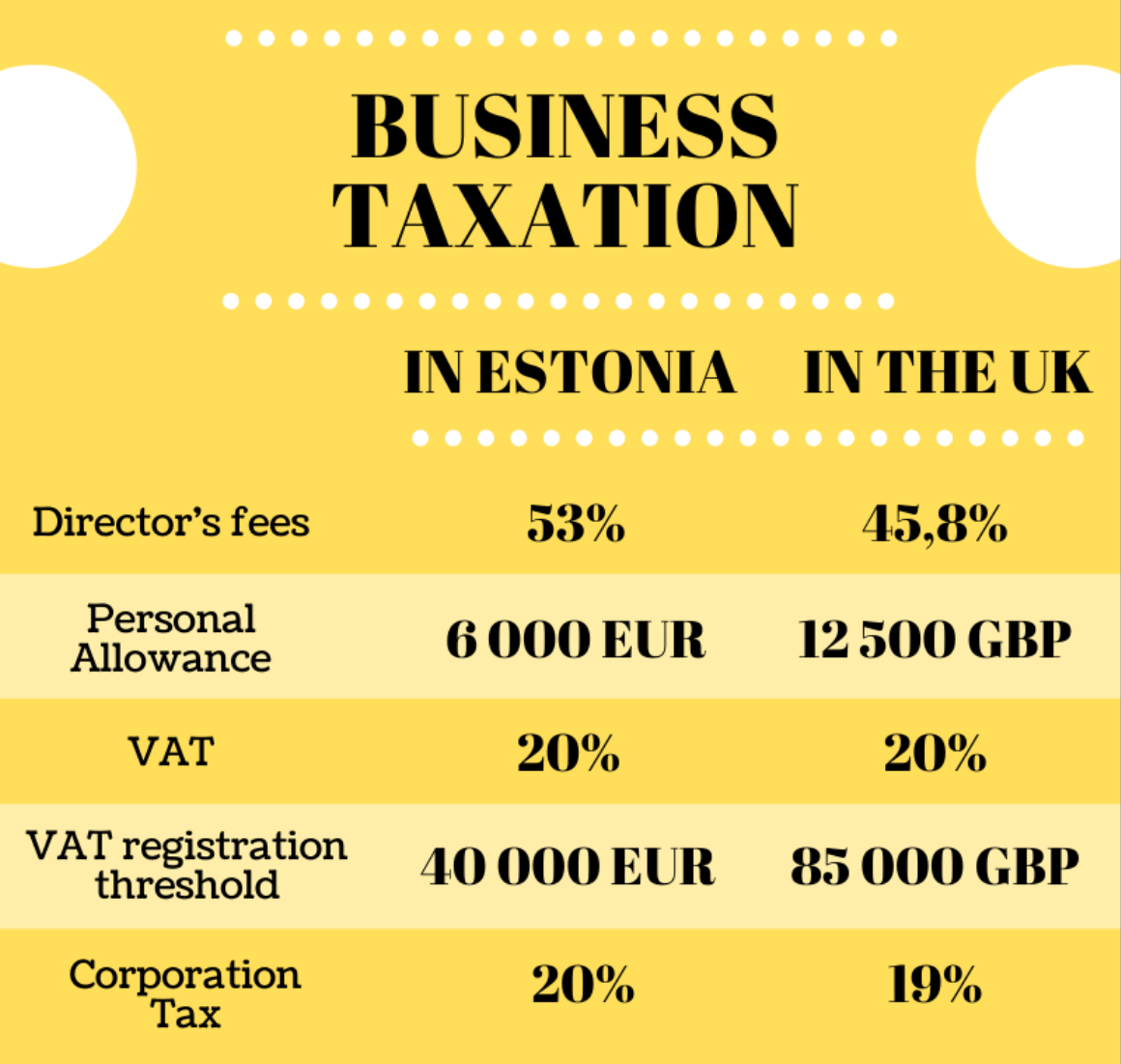

Taxation of director’s fees in Estonia

Director’s fees (or board member salaries) are subject to two taxes in Estonia:

- Income tax (20%)

- Social tax (33%)

The personal allowance (the amount you can earn without paying Income Tax) in Estonia is 6 000 EUR and it applies if your annual income is below 14 400 EUR. The personal allowance decreases gradually between 14 400 EUR and 25 200 EUR annually, and there is no personal allowance for incomes above 25 200 EUR.

Social Tax is applied to all income.

Corporation Tax in Estonia

Estonian Corporation Tax is widely known and plays a role in portraying Estonia as Europe’s tax haven. Why is that?

Because Corporation Tax in Estonia does not apply to retained or reinvested profits. As long as your company keeps or reinvests the profits it makes, it won’t have to pay CTat the end of its accounting year as in most countries.

Estonian Corporation Tax is paid only at the moment of distributing the company’s income through:

- dividends

- share buy-backs

- capital reductions

- liquidation proceeds

- profit distributions (such as transfer pricing adjustments, expenses and payments not related to business, gifts, donations and entertainment expenses).

Such distributions are usually subject to 20% Corporation Tax with some situations where the Corporation Tax rate could be 14%.

VAT in Estonia

The standard rate of VAT in Estonia is 20% with reduced rates in some cases at 9% or 0%.

The VAT registration threshold in Estonia is 40 000 EUR annually, which means that if your revenue from sources subject to Estonian VAT exceeds 40 000 EUR in any 12-month period, the company will be obligated to register for VAT.

Taxes for digital nomads in the United Kingdom

Taxation of director’s fees in the UK

Director’s fees (or board member salaries) are subject to two taxes in the United Kingdom:

- Income tax (20%)

- National Insurance Contributions (12% and 13.8%)

Personal allowance in the UK is currently set at 12 500 GBP annually and starts decreasing (1 GBP decrease for every additional 2 GBP earned) only above 100 000 GBP of annual income.

There are two types of National Insurance Contributions (NICs) in the UK – those paid by the employee and those paid by the employer.

Employee NICs (12%) are paid when your income exceeds the Primary Threshold currently set at 9 500 GBP per year.

Employer NICs (13.8%) are paid when your income exceeds the Secondary Threshold currently set at 8 788 GBP per year.

This means that a person in the UK (or a UK LTD company director) with an annual income below 8 788 GBP will pay 0 GBP in National Insurance Contributions or Income Tax throughout the year.

You will find more information about UK NICs, taxes and their thresholds in the government guidance Rates and thresholds for employers 2020 to 2021

Corporation Tax in the UK

Current Corporation Tax rate in the UK is 19%.

VAT in the UK

The standard rate of VAT in the United Kingdom is 20% with reduced rates in some cases at 5% or 0%.

The VAT registration threshold in the UK is 85 000 GBP annually, which means that if your revenue from sources subject to UK VAT exceeds 85 000 GBP in any 12-month period, the company will be obligated to register for VAT.

Additional thoughts on running a business in Estonia and the United Kingdom

As you can clearly see in the above comparison the UK places a lower tax burden on Limited company owners and directors. Even though Estonia is often portrayed and advertised as Europe’s tax haven and digital nomad capital, the reality is that it has little to offer beyond the deferred Corporation Tax payments.

You can just as easily, or in fact even more easily register a limited company in the UK, with lower costs and without the unnecessary hassle of obtaining an e-Residency card through an embassy or a personal visit to Estonia.

Are you planning to register a limited company to lower the risk and add credibility to your newly established venture?

Do you have any questions as to combining this form of enterprise with your nomadic lifestyle?

Which country should you choose – Estonia, the UK or some other jurisdiction?

It all depends on your particular situation. Write us a message, describe what’s going on and we’ll do our best to help!

info@owlaccounts.com