Fulfillment by Amazon is a service that Amazon provides, where you can sell your goods by sending them your products, and they will take care of storage, delivery to customers, customer service, and returns handling. This article will guide you through some of the principles of FBA and whether it is for you!

The service allows you to essentially skip most of the processes involved with selling and distributing your goods, for a fee of course.

Their main selling point is that you will be able to expand your business by reaching more customers on a continental and even global scale. Amazon states that increased customer reach, will generally lead to increased sales. We frequently deal with many clients that are interested in Amazon FBA as part of their business activities.

This all seems very good but do you need to register for VAT or receive a VAT number? What are kind of costs are involved? Do you sell through a warehouse in a particular country? What kinds of thresholds are involved?

Thresholds for VAT and registration (UK)

Many sellers throughout Europe want to sell their goods in the UK or to UK customers. Their is a need to register as a British VAT payer when your selling falls under certain conditions. For example when your sales turnover reaches £70,000 per year and you are distance selling to the UK, then you must register for VAT in the UK. £70,000/year is the distance selling threshold for goods sold to the UK and applies to any goods you sell, whether it’s through your shop or online. There is also a domestic sales threshold of £85,000, which means you can sell goods within the UK without registering for VAT until you reach this threshold. Selling from a warehouse in the UK also requires you to register as British VAT payer, and if you are using Amazon FBA, then you will be selling goods through their warehouse. The same conditions apply in many other EU countries, and when you cross the domestic threshold or distance threshold, you’ll need to register as a VAT payer in that country. Some countries do not have a domestic threshold and you’ll have to register for VAT immediately if you’re selling within the country. Amazon provides information on these thresholds for the UK, France, Germany, Spain and Italy. Click here to see the thresholds on Amazons portal.

This information is not very clear on Amazon’s website and finding information on VAT services does require some navigating through their portal. There is a broad FAQ section that provides some relevant answers but many answers are quite vague. You can find answers to your VAT related questions in our FAQ section.

If any of your activity with Amazon FBA is subject to VAT then you will need to submit VAT returns and register for VAT in the relevant jurisdiction. For example if you’re selling to the UK or within the UK and need to be registered for UK VAT, you will have to submit quarterly returns (every 3 months) in your ‘accounting period’.

Getting yourself VAT registered in the UK is a fairly simple procedure that involves using the UK Government portal and submitting an online form. Distant sellers registering for UK VAT can download a form online but they must send the form via post when they have filled it out.

How does Amazon act on VAT procedures?

Recently, Amazon have been obliged by HMRC (UK government body responsible for the collection of taxes) to provide sellers with information on VAT registration. Their service now verifies users to make sure they are VAT registered (if necessary). Amazon will prevent further sales from a seller if they do not provide a legitimate VAT number. This is due to many sellers abusing the VAT system and not paying any VAT or the correct amount of VAT, essentially undercutting other compliant businesses that are trying to sell their goods.

Amazon even provides a VAT return service for its customers, costing 400 EUR for the year. An additional 100 EUR can be paid for VAT obligations outside the scope of their platform (amazon marketplace). They use Avalara as a proxy to ensure ‘complete accuracy’.

It would be best to source your own reliable accountant/accounting service for this process, and we can file vat-returns for you and get you VAT registered in Poland or the UK, whether your business is using Amazon FBA or not. We can take care of all your accounting needs!

Advantages and Disadvantages of using Amazon FBA

Advantages

- Packaging, picking and sending of your goods is all done effectively by Amazon.

- Likely increase your sales – Amazon is a solid, trusted service and with your products on their platform you’re more likely to land a sale.

- A large volume of goods can be sent at once/regularly without an issue due to Amazon’s large workforce.

- Your goods are available on the most well known marketplace in the world, making them look attractive and professional.

- No worries about storage space for your packages.

- Having the ability to list your goods for expedited and prime delivery, which gives customers satisfaction that they can receive their purchases very quickly.

- The service isn’t just limited to Amazon’s marketplace, the fulfillment service can be used for other seller sites, including your own.

Disadvantages

- Co-mingling of stickerless packages is common when sellers send their goods to the amazon warehouses (it’s the default option when starting with FBA, unless you have chosen otherwise). When a customer purchases a sellers product online, Amazon will choose the most convenient inventory available, which could mean that the same product from another seller is chosen. The problem here is that if there is an issue with that product, then the seller bears responsibility, even if that product was not even in the original sellers inventory. To avoid this it is worth paying the extra cost to have your products stickered (£0.15 per package).

- Duplicate listing from other sellers, which diverts attention from your products to theirs. This is an act of competition to get another sellers products to be seen.

- Lack of control on your part if something goes wrong e.g. a package is lost, a mistake is made in the order system etc.

- Not being able to see the process of packaging and delivery at each stage. You don’t necessarily know what is happening with your goods in Amazon’s warehouse. E.g. You have no control over what materials they use for packaging, there could be a cheaper alternative.

- High costs – especially if you have a seller account and are using FBA.

Are you selling goods as your sole source of income or is it just a casual enterprise, supplementing your your job?

If you’re selling goods over the internet as your only source of income then Amazon FBA will likely be a good choice for you, as you can focus on operating the business and dealing with customers, whilst your goods are being packaged and delivered. Amazon FBA is not particularly suited to someone just selling casually, as the costs won’t be suitable for a low throughput of products/goods. Packaging and sending these goods yourself would be the better option here and you can still use Amazon marketplace as a seller.

What fees does Amazon charge for their fulfillment services?

There are a few different fees to be aware of and some of them might not apply to your business.

- The Fulfillment Fee – a flat fee per unit, based on the product type, dimension and outbound shipping weight.

- The Storage Fee – a fee charged per cubic metre or cubic foot per month.

- Optional Services Fees – includes packaging services, returns handling and remissions. These are charged separately.

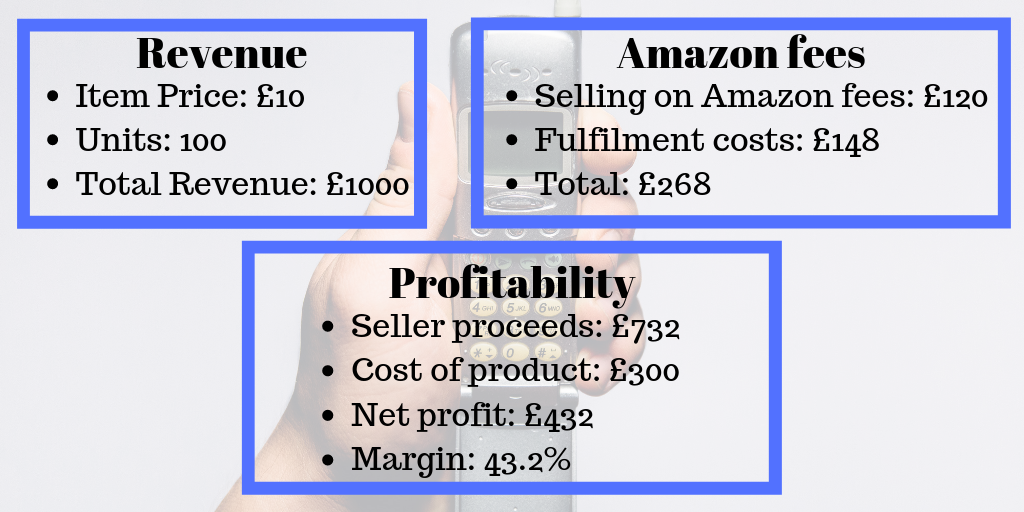

Let’s use an example to explain the above fees [Simon from the UK]

Simon sells his goods online using Amazon FBA. He sells his own brand of mobile phone cases, entirely within the UK. Simon sells 100 cases per month at £10 per unit, which gives him a revenue of £1000 per month. The cost of the cases for Simon is £3 per unit (3x100 = £300/month), so Simon’s markup is ~ 233%. Amazon’s fulfillment costs are £1.48 per unit, with £1.47 going on packaging/delivery (small envelope no more than 100g) and 0.01GBP on storage costs (January -September). 100 units = £148 in FBA fees from amazon/month. There is also a referral fee of £1.20 per unit (depends on the type of product sold). Total amazon fees are £268/month. Simon’s net profit is £432 from his revenue of £1000, giving him a reasonably high profit margin of 43.2%. Now this doesn’t take into account any additional fees to amazon including any optional services, but it’s a basic example of how the fees are applied.

The cost of the fees also depends on the country you’re operating from and the country you’re sending to. These fees can add up a lot per package if you’re not careful, so make sure you check whether you need a particular service or not. For example, it costs £0.15 per package (any size) to label it with a FBA sticker. Stickered packages stop the co-mingling of other seller packages, which is a safer option if you want only your inventory to be used.

Relative to other EU countries (France, Germany, Italy and Spain), the UK has slightly cheaper fulfillment fees.

You will also have to pay to send your goods over to Amazon by using a carrier. Amazon often have offers for free transportation when signing up for FBA (usually up to 200 units). However, these are limited promotions, but they are worth taking advantage of.

Additional seller fees

Don’t forget that if you’re selling on the amazon marketplace, you will have to pay seller fees. If you’re using FBA then you will likely have to use the professional seller plan, which is a flat fee of £25/month. The individual seller plan (fees charged per unit sold) is for smaller volume sales (under 35 units/month), where FBA wouldn’t be viable anyway.

Is FBA the right choice for you or your business?

It’s not if you:

- Sell a small volume of goods.

- Have a small profit margin – you might not be generating enough income to cover Amazon’s FBA fees/seller fees. A suggested markup of at least 200% will be needed if you are to make a successful profit.

- Trade, slow selling items (not high in demand or popularity). These types of goods can incur significant fees, especially if they are being stored by Amazon for long periods of time.

- Sell very large or heavy items. The fees can rack up significantly for heavier/larger goods, where it might be cheaper for you to sell them independently. This can cause a multiplier effect with slow selling items, accumulating significant fees for storage.

It is if you:

- Sell lots of goods, that are in demand.

- Use Amazon as the main marketplace for your selling and income.

- Want to establish a larger selling network and you already sell on other sites such as eBay, etsy etc.

- You have stable (high) profit margins that outweigh the costs of using the services.

Summary and final remarks on FBA

Before you start using FBA services, make sure you’ve done all your research (including reading this guide/article), preparation and calculations on whether it will be profitable for you to sell goods via this intermediary.

You need to have an organized and structured plan to avoid making mistakes such as mislabelling packages or leaving an item in fulfillment centre too long (fines and bans can be imposed for this). Many of your customers will be prime customers who are paying a premium price for an express service, so make sure that your goods are representative of that premium service. Don’t sell counterfeit/fake goods or claim your products are something that they are not, as you will likely find that you will be banned/fined rather quickly. Amazon will follow you very closely during the early stages of your FBA selling career, so follow all rules/procedures carefully, to avoid any problems in the future.

Contact us or arrange a consultation with one our experts, if you’re unsure whether you need to be VAT registered. We will be happy to assist you and answer any questions that you have.

info@owlaccounts.com

| Word/Term | Definition/Description |

| Compliant | In accordance with the rules or a set of standards. |

| Default | Something usual or standard e.g. a preselected option on a computer. |

| Divert(s) | Causing something/someone to change course/direction or draw the attention of someone to something. |

| Essentially | Emphasises something basic or fundamental. Can be used interchangeably with basically. |

| Fulfillment | The state or quality of something being completed. Meeting a requirement or condition. In this case Amazon ‘fulfilling’ orders for sellers to customers via its marketplace. |

| Generate | Produce or create. |

| Intermediary | A company or person who acts as a go-between between parties for a business deal, negotiation etc. e.g. Amazon operates as an intermediary between sellers and customers on its site. |

| Undercutting

(business) |

Offering goods/services to customers at a lower price/rate than competitors. E.g. Undercutting other businesses by avoiding paying VAT. |